The tax return figures of Pakistani parliamentarians never cease to amaze and the statistics for the year 2018 released on Friday have not disappointed either as they show that only five lawmakers paid 60% of the total amount paid by members of the lower and upper houses of parliament in taxes.

Making matters more interesting, the Tax Directory 2018, which the PTI government launched on Friday after delay of almost one and half years, also reveals that 45 members of parliament did not even submit their income tax returns to the Federal Board of Revenue for that year.

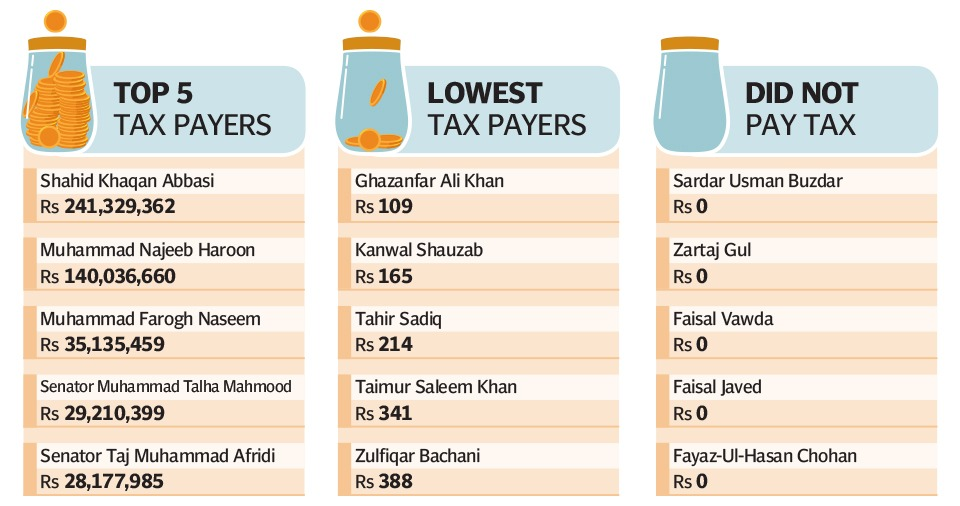

Former prime minister Shahid Khaqan Abbasi, who is also the senior vice president of the PML-N, leads the list of the highest tax-paying lawmakers as he paid Rs241.3 million in income tax during the year when he was premier of the country.

His returns were 8,000% higher than the previous year and also equal to 30% of the total taxes paid by all members of parliament.

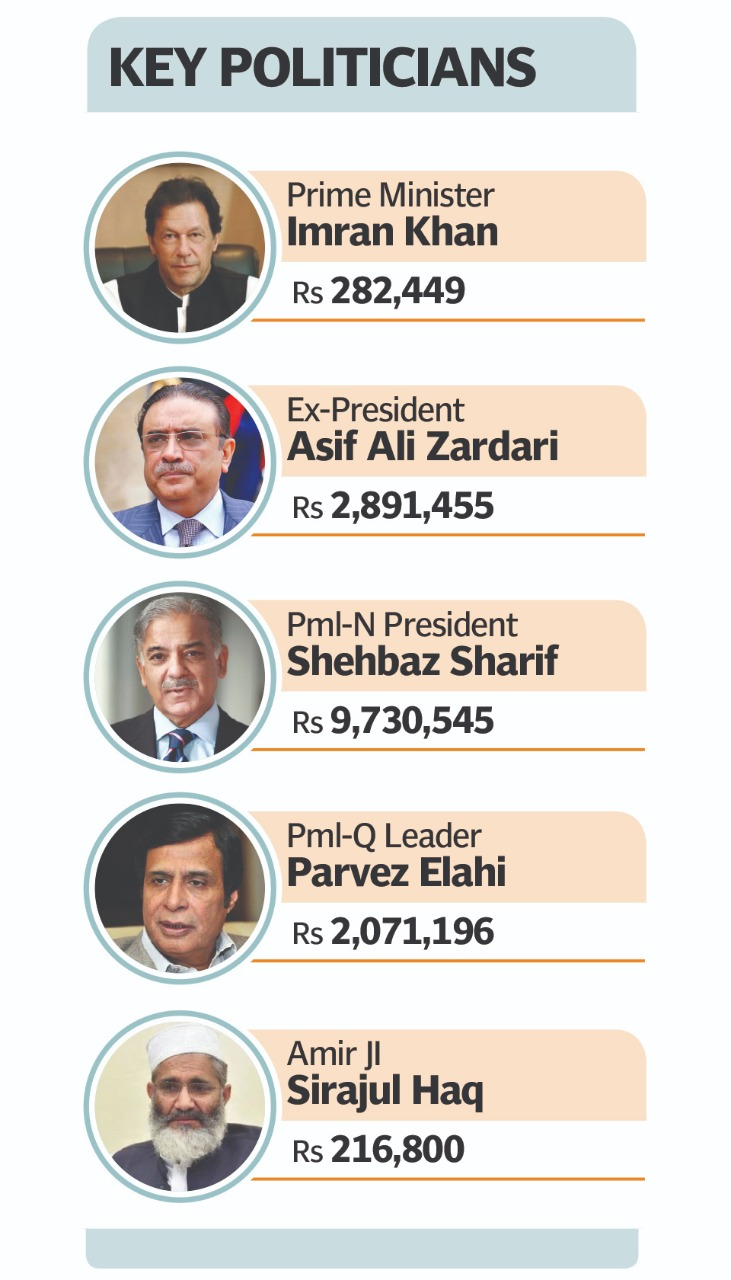

The tax returns of Prime Minister Imran Khan also jumped by 172% to Rs282,449 in 2018 in comparison with the previous year. As a tax year starts on July 1 and ends on June 30, the figures were submitted during the first year of the PTI government.

The figures show that tax contributions of the parliamentarians are constantly increasing since the launch of the first edition seven years ago.

However, they remain below potential given the lawmakers’ lifestyles.

Of the 401 National Assembly and Senate members, who submitted their income tax returns for 2018, 70 paid more than Rs1 million.

But after excluding the top five taxpayers who paid almost 60% of the total taxes, the payments by the remaining 396 members are very low.

Adviser to PM on Finance Dr Abdul Hafeez Shaikh, while launching the tax directory, said 311 MNAs and 90 senators submitted their income tax returns for the year 2018 and paid Rs800 million.

Former premier Abbasi paid Rs241.3 million in income tax against Rs3.1 million in the preceding tax year.

Sources close to the ex-PM said that the abnormal jump in his tax liabilities was because of the change in the shareholding of the Airblue company.

The second highest amount in taxes -- Rs140 million – was paid by PTI MNA Najeeb Haroon, followed by Rs35 million by Law Minister Barrister Farogh Nasim, Rs29.2 million by Senator Talha Mehmood of the JUI-F and Rs28.2 million by Senator Taj Afridi who was elected as an independent candidate from Khyber district.

Excluding these top five taxpayers, the remaining members of parliament paid Rs326 million.

In the tax year 2017, parliamentarians had paid Rs535 million in taxes – a figure that jumped by almost half to Rs800 million in the next year.

The fact that 45 members of parliament did not submit their income tax returns for tax year 2018 does not reflect well on the performance of the FBR.

There was no statement by the FBR as to whether any action had been taken against these parliamentarians or not.

Similarly, there are dozens of parliamentarians whose tax contributions do not match their lifestyles.

Water Resources Minister Faisal Vawda and Climate Change Minister Zartaj Gul did not pay any tax in 2018.

Industries and Production Minister Hammad Azhar paid slightly over Rs22,000 in income tax but his partnership firm paid Rs59 million, which is separate from Azhar’s personal tax contribution.

Azhar tweeted that of that Rs59 million, there was a contribution of Rs18 million by his association of person on account of his shareholding.

Planning and Development Minister Asad Umar paid over Rs5.4 million, which was about 55% of the taxes paid by PML-N President Leader of the Opposition Shehbaz Sharif.

Umar tweeted that Shehbaz’s tax contribution was far less than the assets held by the former Punjab chief minister.

The PML-N president paid Rs9.7 million in income tax against Rs10.3 million in the preceding year.

Umar’s tax contribution increased from Rs4.8 million to Rs5.4 million.

Pakistan implements a self-assessment tax regime, where the taxpayer has the liberty to declare his tax contribution. However, self-assessment is only successful if there is strong tax audit regime.

All the successive governments, including that current one of the PTI, have shied away from strengthening the audit wing of the FBR and it does not have human resource to conduct an audit of taxpayers.

The finance adviser also held computer balloting for the audit of taxpayers for the tax year 2018.

Only 10,441 or 0.76% of the total income tax returns filed, excluding those filed by the salaried class, were selected for the audit.

“We want to conduct an audit of a small number of people so that there is less harassment and the cases are timely concluded,” Shaikh said.

The adviser said the salaried class and the people who availed tax amnesty in 2018 were excluded from the audit purview.

On the returns filed by members of provincial assemblies, it was pointed out that Sardar Yar Muhammad Rind, a member of the Balochistan Assembly and special assistant to PM on Balochistan affairs, paid only Rs400 in taxes.

Shaikh said all members of provincial assemblies paid only Rs340 million in income tax in 2018.

Punjab Chief Minister Sardar Usman Buzdar did not pay any tax.

Sindh Chief Minister Murad Ali Shah paid Rs896,357, Khyber-Pakhtunkhwa Chief Minister Mahmood Khan Rs353,809 and Balochistan Chief Minister Jam Kamal Rs4.8 million.

Former president Asif Ali Zardari tax returns come up to Rs2.9 million. Punjab Assembly Speaker Chaudhry Perveiz Elahi paid Rs2 million in income tax, Senate Chairman Sadiq Sanjrani Rs1.4 million, Senate Deputy Chairman Saleem Mandviwalla Rs1.6 million, National Assembly Speaker Asad Qaiser Rs537,730 and Bilawal Bhutto Zardari Rs294,117.

Province-wise figures belie the claim that Sindh pays 70% of the country’s taxes. The tax directory analysis showed that Sindh’s contribution in the total income tax was 44.9%, followed by Punjab with 35%, Islamabad Capital Territory 15%, Khyber-Pakhtunkhwa 3.5% and Baluchistan 1.7%.

The ICT has a higher share because major oil and gas and telecommunication companies are registered in the federal capital.

In absolute terms, Karachi’s income tax contribution was Rs395.3 billion, Islamabad Rs204 billion, Lahore Rs201 billion, Rawalpindi Rs35 billion, Faisalabad Rs17.5 billion, Multan Rs17 billion, Hyderabad Rs14 billion, Peshawar Rs13.6 billion, Quetta Rs10 billion and Sialkot Rs4.5 billion.

Illustrations: Ibrahim Yahya

1714024018-0/ModiLara-(1)1714024018-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ